At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

At one point or another, you’ve probably heard someone say, “Yesterday was the best time to buy a home, but the next best time is today.”

Over the past 5 years, home prices have risen dramatically. If you own a home, that means your house may be worth a lot more than you think.

Over the past 5 years, home prices have risen dramatically. If you own a home, that means your house may be worth a lot more than you think.

It’s no secret that remote work has surged over the last few years.

It’s no secret that remote work has surged over the last few years.

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection.

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection.

More people are taking steps to buy a home. And, if you’ve been waiting for the right time to move, this may be the sign you’ve been looking for.

More people are taking steps to buy a home. And, if you’ve been waiting for the right time to move, this may be the sign you’ve been looking for.

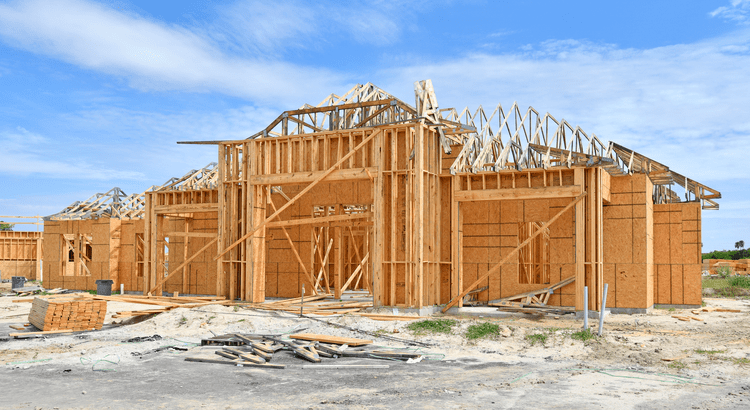

When searching for a home, you don’t want to skip over new builds as an option.