America has faced its share of challenges in 2020. A once-in-a-lifetime pandemic, a financial crisis leaving millions still unemployed, and an upcoming presidential election that may prove to be one of the most contentious in our nation’s history all continue to test this country in unimaginable ways.

Even with all of that uncertainty, the residential real estate market continues to show great resilience. Here’s a look at what the experts have said about the housing market over the past few weeks.

Ivy Zelman, CEO of Zelman & Associates:

“Whether in terms of pending contract activity or our proprietary buyer demand ratings, the various measures of demand captured in this month’s survey can only be described as shockingly strong, in spite of the resurgence in COVID-19 cases.”

Logan Mohtashami, Lead Housing Analyst at HousingWire:

“Existing home sales are still down year over year by 11.3%, but as crazy as this might sound, we have a shot at getting positive year-over-year growth…We may see an existing home sales print of 5,510,000 in 2020.”

Matthew Speakman, Zillow Economist:

“In a remarkable show of resilience, the housing market has stared the pandemic right in the eye and hasn’t blinked.”

Todd Teta, Chief Product Officer for ATTOM Data Solutions:

“The housing market across the United States pulled something of a high-wire act in the second quarter, surging forward despite the encroaching economic headwinds resulting from the Coronavirus pandemic.”

Ali Wolf, Chief Economist of Meyers Research:

“The housing recovery has been nothing short of remarkable. The expectation was that housing would be crushed. It was—for about two months—and then it came roaring back.”

Clare Trapasso, Senior News Editor of realtor.com:

“Despite the crippling and ongoing coronavirus pandemic, millions out of work, a recession, a national reckoning over systemic racism, and a highly contentious presidential election just around the corner, the residential real estate market is staging an astonishing rebound.”

Bill Banfield, EVP of Capital Markets at Quicken Loans:

“The pandemic has not stopped the consistent home price growth we have witnessed in recent years.”

Economic & Strategic Research Group at Fannie Mae:

“Recent home purchase measures have continued to show remarkable strength, leading us to revise upward our home sales forecast, particularly over the third quarter. Similarly, we bumped up our expectations for home price growth and purchase mortgage originations.”

Mark Fleming, Chief Economist at First American:

“It seems hard to deny that when one looks at many of the housing market statistics, a “V” shape is quite apparent.”

Bottom Line

The experts seem to agree that residential real estate is doing remarkably well. If you’re thinking of jumping into the housing market (whether buying or selling), this may be the perfect time.

Content previously posted on Keeping Current Matters

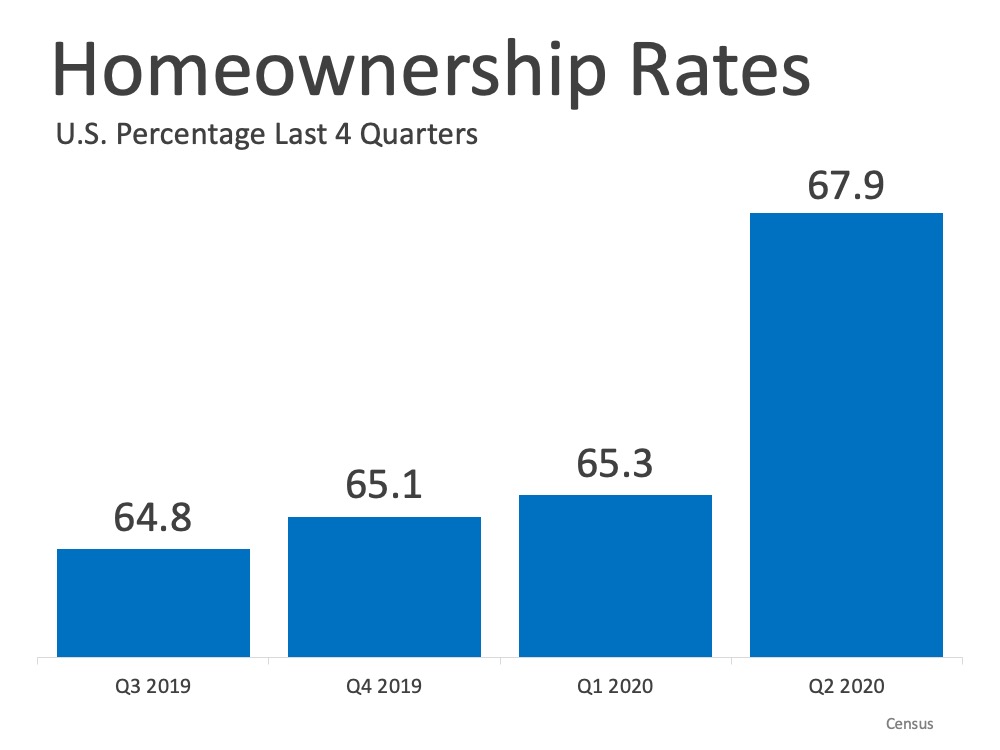

When shelter-in-place orders brought the economy to a screeching halt earlier this year, many believed the residential housing market would follow suit. Countless analysts predicted buyer demand would disappear and home values would depreciate for the first time in almost a decade. That, however, didn’t happen. It appears the opposite is taking place. After the […]

When shelter-in-place orders brought the economy to a screeching halt earlier this year, many believed the residential housing market would follow suit. Countless analysts predicted buyer demand would disappear and home values would depreciate for the first time in almost a decade. That, however, didn’t happen. It appears the opposite is taking place. After the […] When shelter-in-place orders brought the economy to a screeching halt earlier this year, many believed the residential housing market would follow suit. Countless analysts predicted buyer demand would disappear and home values would depreciate for the first time in almost a decade. That, however, didn’t happen. It appears the opposite is taking place. After the […]

When shelter-in-place orders brought the economy to a screeching halt earlier this year, many believed the residential housing market would follow suit. Countless analysts predicted buyer demand would disappear and home values would depreciate for the first time in almost a decade. That, however, didn’t happen. It appears the opposite is taking place. After the […] Originally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some even worried that we might relive the 2006-2008 housing crash all over again. Once you examine the data, however, that seems unlikely. […]

Originally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some even worried that we might relive the 2006-2008 housing crash all over again. Once you examine the data, however, that seems unlikely. […] The residential real estate market has definitely been the shining light in this country’s current economic situation. All-time low mortgage rates coupled with a new appreciation of what a home truly means has caused the housing market to push forward through this major health crisis. Let’s look at two measures that explain the resilience of […]

The residential real estate market has definitely been the shining light in this country’s current economic situation. All-time low mortgage rates coupled with a new appreciation of what a home truly means has caused the housing market to push forward through this major health crisis. Let’s look at two measures that explain the resilience of […] In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly starting to come back into the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research […]

In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand. Now, however, we’re seeing sellers slowly starting to come back into the market, a bright spark for potential buyers. Javier Vivas, Director of Economic Research […] The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the […]

The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the […] With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of […]

With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of […]

![Where Is the Housing Market Headed in 2020? [INFOGRAPHIC] | Simplifying The Market](https://blog.sfloridaluxuryhomes.com/wp-content/uploads/2020/07/20200730-MEM-scaled-1.jpg)